MAKING INSURANCE YOUR POLICY

BE SAFE, NOT SORRY: PROTECTING YOUR FAMILY

LIFE INSURANCE

In the event of your passing, life insurance pays a benefit to your survivors, also known as beneficiaries. There are two main types of life insurance: TERM and WHOLE.

Term life insurance is the easiest life insurance to understand: it provides death benefit protection without any savings, investment or “cash value” components. It is usually the most affordable (and most popular) kind of life insurance. Term insurance is purchased for a specific period of time, usually 10, 15, 20 or 30 years. If you outlive your policy term, the insurance coverage terminates and you must buy another policy if you still want to carry life insurance. However, the annual premium for another policy could be much more expensive because your older age and any health conditions are taken into account. That’s why it’s important to choose a suitable term length early in life, when the rates are most favorable.

Whole life insurance also contains a cash value account that builds over time, slowly at first and gaining momentum after several years. You can withdraw the cash value you’ve accrued or take out a loan against it. But remember, if you die before you pay back the loan, the death benefit paid to your beneficiaries will be reduced by the amount of money that was not paid back.

DISABILITY INSURANCE

Disability insurance is an important component of your family-protecting coverage. It will replace a portion of your income if you are unable to work due to a disabling illness or injury. Why is that important? Take a quick estimate – how much money do you have on hand in savings? Now estimate your monthly expenses. How long could you make ends meet if your paycheck suddenly disappeared, and you had to live solely on your savings? A LIFE Foundation survey found that a majority of those who lost their incomes wouldn’t make it more than a month before serious financial sacrifices would have to be made. Plus, if you were struggling to meet everyday expenses, how would you continue to save money to fund your retirement needs?

Many larger companies and some smaller ones offer some disability coverage to employees through a group plan. If you need more, it may make sense to buy additional coverage through your employer’s group plan, if available. Buying your own disability insurance policy independently is also option worth considering. Unlike group coverage, privately owned insurance stays with you even when you change jobs. To find out more about disability insurance and if you need coverage, use our Interactive Planner.

LONG-TERM CARE INSURANCE

One of the biggest threats to your retirement plans is the cost of long-term care. The median cost of a private room in a nursing home is almost $90,000 or more, depending on the state you live in, according to a recent Genworth survey. Home care can cost $250-300 per day, or more. If you or your spouse become chronically ill or disabled, it’s easy to see how your savings could be wiped out. Medicaid, a government program, only kicks in once your assets are significantly depleted, and you may not get exactly the care you’d like. That’s why long-term care insurance should be a serious consideration in your financial planning at this stage. As with most insurance programs, purchase your long-term care policy as early as possible, for the lowest rates. So this is your best time to learn more. Start with AARP and Genworth for insights on when to buy, how to get the best value, plus a cost calculator.

SAVINGS AND INVESTMENTS

Many workers from our parents’ generation could count on a financially secure retirement thanks to a guaranteed lifetime pension from their employers. That’s no longer the case. These days, workers must take responsibility for their own retirement. By this point you should have quite a bit of savings tucked away in a 401(k), IRA, or some other type of tax-deferred retirement plan. If not, it’s never too late to get going. Most of these plans have a so-called “catch-up” provision that allows you to contribute extra money. For example, the $17,500 maximum annual contribution to a tax-deferred retirement plan rises to $23,000 once you turn 50.

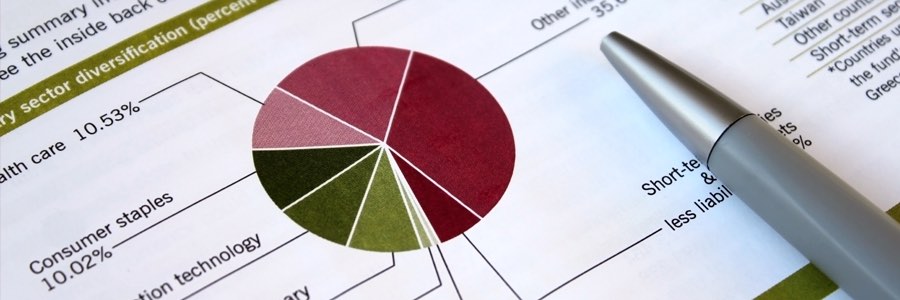

Make sure your retirement investments are well diversified. Many workers unwittingly allow their own company’s stock to take up a dangerously large portion of their retirement accounts. Companies often encourage this by offering their stock for sale to employees at a discount or by using it to match retirement plan contributions. But if you’re receiving a regular paycheck—not to mention health insurance and other benefits—from a company, a great deal of your personal financial security already rides on the fortunes of that firm. Don’t compound that risk by making its stock a large part of your retirement portfolio.